In today's financial landscape, predatory lending has become an alarming issue, affecting borrowers across all demographics. These loans often come with exorbitant interest rates, hidden fees, and terms designed to trap borrowers in a cycle of debt. Understanding how to avoid these pitfalls is crucial for anyone considering a loan, especially those in vulnerable financial situations.

This article aims to equip you with the knowledge to navigate the murky waters of lending. We'll explore the various tactics employed by predatory lenders and provide practical steps to protect yourself. By being informed and vigilant, you can secure loans that are not only suitable for your needs but also affordable and sustainable in the long run.

To safeguard against predatory lending, it’s essential to be proactive. By recognizing red flags, understanding your rights, and considering alternative options, you can make informed decisions and avoid being preyed upon by unscrupulous lenders. Let's dive into the strategies that will empower you to take control of your financial future.

1. Understand the Terms

Before entering into any loan agreement, it is vital to thoroughly understand all the terms and conditions. Many borrowers make the mistake of signing contracts without reading the fine print, leading to unforeseen consequences down the road. Take the time to review the details, including repayment schedules, fees, and interest rates, to ensure you know what you're committing to.

Pay special attention to the terminology used in the loan agreement. Terms like 'APR' (Annual Percentage Rate), 'prepayment penalties,' or 'default' can have significant implications on your financial obligations. Understanding these concepts can help you make an informed decision and avoid getting trapped by unfavorable conditions.

If something in the agreement is unclear, don't hesitate to ask questions. A reputable lender should be willing to explain the terms and conditions to your satisfaction. Avoid lenders who rush you into signing or who are evasive about specific details; this could be a sign of predatory practices.

- Read the entire loan document before signing.

- Ask for clarification on any terms that seem confusing or vague.

- Be aware of how penalties and fees can impact your overall loan cost.

2. Check for Hidden Fees

Hidden fees are one of the most deceptive tactics used by predatory lenders to trap unsuspecting borrowers. These fees can significantly inflate the cost of a loan, making it appear more affordable than it truly is. It's crucial to ask for a detailed breakdown of all fees associated with the loan before making any commitments.

Common hidden fees may include application fees, processing fees, and late payment fees, among others. Even seemingly small fees can accumulate over time and add substantial costs to your loan. Make sure to inquire about these charges and factor them into your decision-making process.

A careful examination of the loan documents can reveal any red flags related to hidden fees. If a lender is unwilling to provide transparency about their fees, it’s best to reconsider taking out a loan with them.

3. Be Wary of High-Interest Rates

High-interest rates are one of the hallmark signs of predatory lending. While it's normal for lenders to charge interest on loans, rates that are excessively high can trap borrowers in a cycle of debt that can be difficult to escape. It's essential to compare interest rates among different lenders to ensure you're getting a fair deal.

Consider the broader implications of a high-interest rate loan. While you may be initially tempted by a loan offer, the long-term cost could far exceed the value of the loan itself. Higher monthly payments can strain your finances and impact your ability to save or invest in your future.

Always check the national average for interest rates on loans similar to what you are seeking. If a lender offers rates significantly higher than average, it should raise a red flag and prompt further investigation. Be mindful and cautious when dealing with lenders who don’t adhere to standard interest rates.

- Research average interest rates for the type of loan you need.

- Calculate what your monthly payments will be before accepting the loan.

- Consult with financial advisors if unsure about a lender's rates.

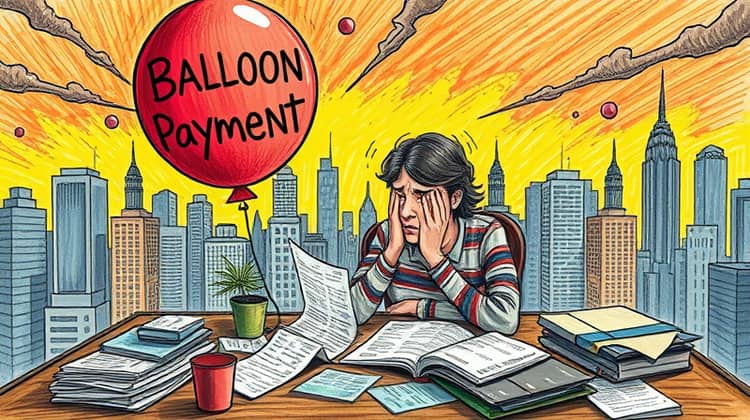

4. Avoid Balloon Payments

Balloon payments are large payments due at the end of a loan term and can pose a significant financial burden on unsuspecting borrowers. While loans with smaller monthly payments may seem attractive, they often result in a hefty lump sum payment later that can be impossible to meet. It’s crucial to understand the structure of your loan before agreeing to any terms.

Many predatory lenders exploit balloon payment structures to entice borrowers into loans they cannot afford. This tactic can lead to a debt spiral, with borrowers needing to take out additional loans just to meet the balloon payment, further complicating their financial situation.

Ensure you have a clear plan for how you'll handle payments at the end of the loan term. If a balloon payment is included in the contract, consider looking for a loan that features more manageable repayment options.

5. Don’t Be Pressured

A common tactic used by predatory lenders is to pressure borrowers into making quick decisions. They may use high-pressure sales techniques to create a sense of urgency, promoting the idea that failing to act immediately will result in missing out on an opportunity. This tactic is manipulative and should raise red flags.

Take your time to think through any loan offers presented to you. Never feel rushed into signing a contract, as this often leads to poor decisions that can have lasting financial consequences. Be wary of any lender who insists that you must sign on the dotted line right away.

A legitimate lender will respect your need for time to consider your options and will encourage you to seek advice from trusted financial advisors. If you feel uncomfortable or pressured, it’s best to walk away and explore other lending options.

Remember, it’s your right to make an informed decision. Protecting your financial wellbeing should always come before any perceived urgency from a lender.

- Take your time to review loan offers.

- Seek advice from financial professionals before deciding.

- Do not let lenders pressure you into quick decisions.

Ultimately, giving yourself time allows you to consider all aspects of the loan and make the best decision for your situation.

6. Seek Alternatives

If you find yourself needing to borrow money, take the time to explore alternative options before committing to a loan. Several resources may be available that could provide financial support without the risk of predatory lending. These options can include credit unions, community banks, or nonprofit organizations that offer loans at fair terms.

Researching alternative lenders can uncover trustworthy options that suit your needs better. Many credit unions offer lower interest rates and more favorable repayment terms than traditional banks or predatory lenders. Additionally, nonprofit organizations frequently provide assistance to borrowers, particularly those in low-income or difficult financial situations.

Consider other financial solutions as well, such as personal savings, borrowing from friends or family, or even exploring community assistance programs. Each of these options may allow you to avoid the pitfalls of predatory lending entirely, enabling you to maintain better control over your financial future.

The internet is rife with resources that can point you toward reputable lenders and alternatives; spending time doing your research can pay off in the long run.

Remember that taking the time to evaluate your options isn’t just prudent; it can also empower you to make decisions that benefit your financial health in the long run.

Before accepting any loan offer, ask questions and ensure you fully understand each option available to you. Every bit of research can help you avoid falling victim to predatory practices.

Ultimately, by seeking out alternatives, you increase your chances of finding a loan that aligns with your needs while avoiding the traps set by unscrupulous lenders.

- Research local credit unions and community banks.

- Look into nonprofit organizations that offer fair lending practices.

- Consider personal savings or borrowing from family before taking out a loan.

7. Know Your Rights

Understanding your rights as a borrower is crucial in protecting yourself from predatory lending practices. Laws vary by region, but many consumer protection laws exist to safeguard borrowers from unfair treatment. Take the time to familiarize yourself with these rights and the legal recourse available to you.

Some key rights include the right to disclosure, which ensures lenders provide complete and comprehensible information about loan terms, such as interest rates and fees. Additionally, you have the right to dispute unfair practices and report lenders that engage in deceptive tactics.

If you find yourself a victim of predatory lending, numerous support organizations and government agencies can help you navigate the complexities of reporting issues and seeking resolution.